Google is on trial for allegedly abusing its dominance of the $200 billion digital advertising industry.

The U.S. Department of Justice claimed that through acquisitions and anticompetitive conduct, Google seized sustained control of the full advertising technology (“adtech”) stack: the tools advertisers and publishers use to buy and sell ads, and the exchange that connects them.

In response, Google denied the claims stating several ad companies compete in the space, a mixture of tools are used so they don’t get the full fees, their fees are lower than industry average and small businesses will suffer the most if they lose this case.

The outcome of the landmark case could bring significant changes to Google and publishers. However, experts argue that could seriously hurt advertisers as well.

It’s equally possible the trial will result in no changes and Google will be free to continue operating as it wants.

Day 1: Accusations and badgering of witnesses (Sept. 9)

DOJ laid out their accusations as follows:

Google controls the advertiser ad network.

Google dominates the publisher ad server.

Google runs the ad exchange connecting the two.

Google’s defense:

Disputed the definition of open-web display ads.

Argued the DOJ’s market definition is “gerrymandered” – the DOJ are manipulating the boundaries of their definition to make Google out to be the bad guy.

Presented a chart showing competitors like Microsoft, Amazon, Meta, and TikTok.

Bottom line. This trial could determine whether Google’s control over digital advertising constitutes an illegal monopoly, potentially affecting how information is disseminated online.

Day 2: Google keeping publishers hostage & could be more transparent (Sept. 10)

Stephanie Layser, former ad exec at News Corp, testifies:

Google’s ad tools leave publishers feeling “stuck”. She explained that NewsCorp wanted to switch ad servers back in 2017, but the revenue risk was too high because of Google ads demand.

40-60% of NewsCorp revenue was from AdX, and of that, 40-60% was Google Ads demand.

Google ad server tech is outdated but unavoidable due to the lack of viable alternatives and the platform’s overwhelming market presence. “DFP (Google Ads Manager) isn’t a superior product – it’s a ’20-30 year old’ piece of “slow and clunky” tech

Jay Friedman, CEO of Goodway Group, criticized Google’s variable pricing, describing it as “gaming the system.” His testimony highlighted Google’s inherent conflict of interest in controlling both the buy- and sell-side of the ad market.

Eisar Lipkovitz, former Google VP of Engineering, provided a candid view of Google’s internal dysfunction, noting that Google’s ad auction practices were unfair and lacked transparency.

It was “stupid” and “idiotic.” “They don’t want to do anything,” he says, “just want to talk about stuff” and “lie” or “omit information.”

He also likened Google’s dominance to a financial firm controlling the stock exchange, acknowledging the need for industry regulation.

Day 3: Google has too much data, stifles competition (Sept. 11)

Jed Dederick, CRO at the Trade Desk (representing DV360’s main competitor), emphasized that buy-side and sell-side interests should remain separate, highlighting the conflict in Google controlling both.

Google’s access to vast user data (via YouTube, Search) gave them a significant competitive advantage, making it difficult for other platforms to thrive.

Other key themes argued:

Google’s control over ad servers stifles competition and innovation (Brad Bender, Ex-Google Product Lead).

Practices like First Look and Dynamic Revenue Share favor Google at the expense of publishers (Ravi Ramamoorthi, UC San Diego Professor).

Day 4: Google controls publisher ad prices and competition (Sept 12)

Key Players:

Rahul Srinivasan, former Product Manager at Google, oversaw the 2019 rollout of UPR (and the shift to a unified first-price auction model. His testimony shed light on internal discussions to “dry out” header bidding and maintain control over ad pricing, despite publisher resistance.

Rajeev Goel, CEO of Pubmatic, and Tom Kershaw, former CTO of Magnite, described the challenges of competing with Google, emphasizing how Google’s demand-side dominance hurt competition and suppressed publisher revenue.

Key Testimony Highlights:

Google faced backlash from publishers during the 2019 rollout of UPR (Unified Pricing Rules), with complaints about losing control over pricing floors and transparency in the auction process.

Internal emails revealed that Google considered lowering its take rate to ease publisher concerns but ultimately decided to push ahead with UPR, bundling it with other changes to reduce resistance.

Rajeev Goel discussed the negative impact of Google’s first-look auction system on both publishers and advertisers, emphasizing that it suppressed competition and reduced revenue diversity.

Day 5: Trial is moving faster than expected + Google’s trial media center (Sept 13)

The trial is moving faster than expected, with DOJ now anticipating half the originally planned time to present their case. Judge Brinkema has encouraged both sides to streamline their arguments, especially around the highly debated “header bidding” topic.

Key Players:

Tom Kershaw (Former CTO, Magnite) highlighted how publishers rely on Google’s ad servers despite alternatives like Prebid. He compared using only Prebid demand to “starving to death,” emphasizing publishers’ limited options.

Chris LaSala (Former Manager, Google) shared internal discussions revealing Google’s awareness of its high take rates and the importance of its unique demand, pushing to commoditize its ad exchange business rather than “extracting high rent.”

Brian Boland (Former VP, Meta) discussed Facebook’s concerns over Google’s preferential treatment of its ad exchange and FAN’s struggle to compete in the open web display space, ultimately leading to FAN’s exit from that market.

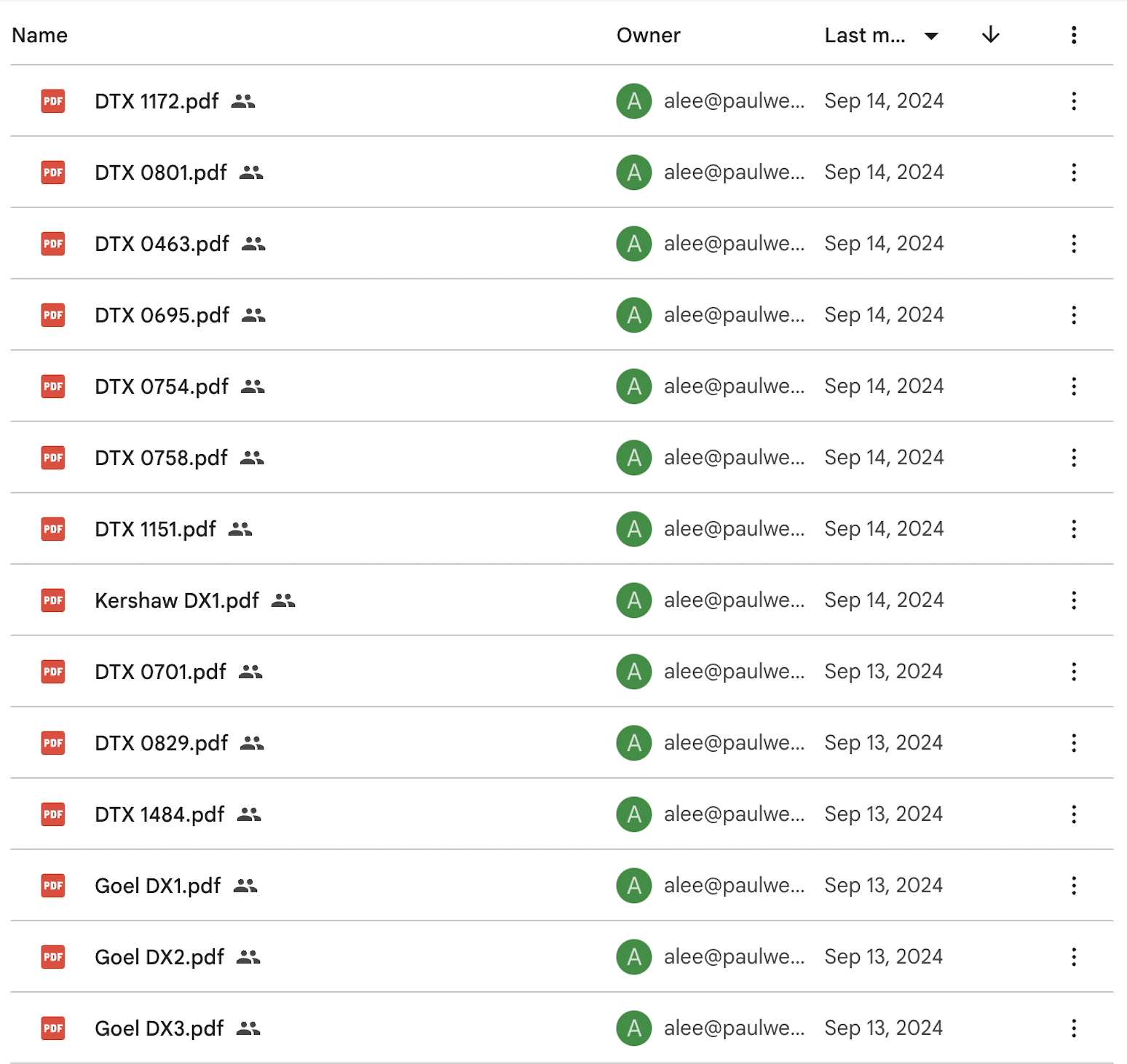

Google has created a “trial media center” website where they are posting documents related to the case. It is unclear if all trial documents are made available there. Google hasn’t widely publicized the location of these documents but it was spotted and shared by Arielle Garcia, Director of Intelligence at digital advertising watchdog Check My Ads, on X.

What’s next. The trial is expected to last a few weeks. If the DOJ wins, Google could face up to $100 billion in advertiser lawsuits, according to Bernstein analysts.

Dig deeper. You can dig deeper into trial updates on the United States vs. Google website.

The other huge Google antitrust trial. In August, a federal judge ruled in a separate case that Google violated antitrust law. Dig deeper into that trial in our article, U.S. vs. Google antitrust trial: Everything you need to know.

This article will be regularly updated with the latest developments from this landmark trial.

Search Engine Land