Google is on trial for allegedly using underhand tactics to ensure it stays the world’s leading search engine.

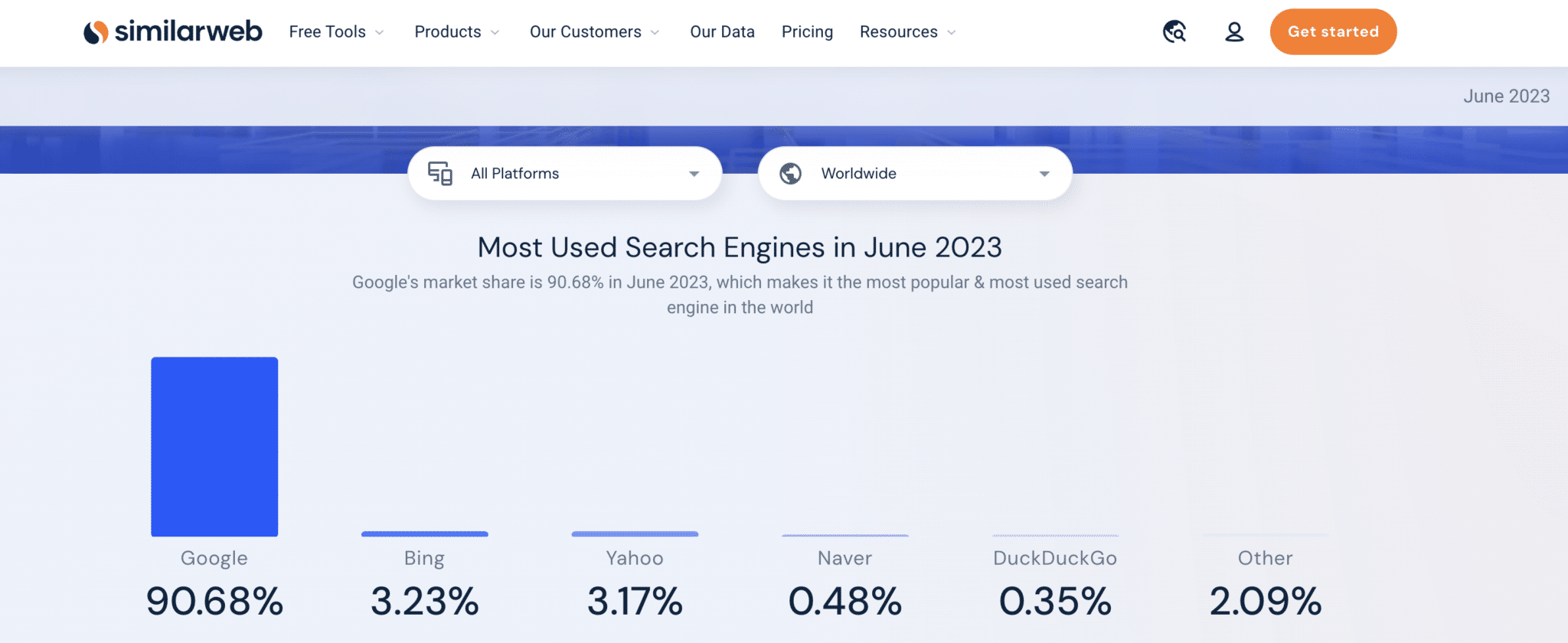

The U.S. Justice Department claims Google, which owns a 90% market share in search, paid massive sums to companies like Apple to make it the default search engine on products like the iPhone.

These multibillion-dollar deals gave Google an unfair advantage, the DOJ alleges, making it nearly impossible for rival companies to compete.

The trial will last 10 weeks and include testimonies from key figures like Alphabet and Google CEO Sundar Pichai.

The outcome of the landmark case could bring significant changes to Google and the future of the Internet. But it’s equally likely the trial will result in no changes and Google will be free to continue operating however it wants.

We’ll keep updating this article with the latest developments from this landmark trial.

As the trial is set to cover many Google search-related issues, we have organized the updates by topic to make the timeline easier to follow.

Search engine competitors and claims of harm

Potentially anticompetitive conduct

Google search dominance

Google credits its 90% market share to being a superior platform (Sept. 12

John Schmidtlein, lead lawyer for Google, claims the company dominates the search market due to being a superior product.

Google argues that users can easily switch to rival search engines even if it’s the default.

Antonio Rangel, a California Institute of Technology economist, testified that Google’s defaults discourage users from switching, saying switching to a different search engine is not easy.

He cited an example where switching to Bing from Google on an Android 12 phone required 10 steps, describing it as “considerable choice friction”, reports Business Insider.

Google calls its competition ‘inferior’ (Sept. 12)

Google’s lawyer, Schmidtlein, argued in court that the government is pursuing a regressive lawsuit.

He said the claims was “all in the hopes that forcing people to use inferior products in the short run will somehow be good for competition in the long run.”

Google is ‘using clicks in rankings’ (Sept. 20)

Former 17-year employee of Google, Eric Lehman, who worked as a software engineer on search quality and ranking told the trial that “pretty much everyone knows we’re using clicks in rankings.”

He added: “That’s the debate: ‘Why are you trying to obscure this issue if everyone knows?’”

Lehman also claimed that Google’s machine learning systems BERT and MUM are becoming more important than user data, and that Google will rely more heavily on machine learning to evaluate text than user data.

According to reporting from Big Tech on Trial (via X), Lehman said: “We try to avoid confirming that we use user data in the ranking of search results.”

The reporter X post said: “I didn’t get great notes on this, but I think the reason had something to do with not wanting people to think that SEO could be used to manipulate search results.”

Search engine competitors and claims of harm

Microsoft says Google’s mobile search is a superior product (Sept. 28)

CEO of Advertising and Web Services Mikhail Parakhin told the court that Microsoft’s mobile search is not as good as Google’s mobile search.

He went on to say that it would be “uneconomical” for Microsft to invest more into mobile search because the company would not be able to distribute it as scale, reports Bloomberg.

Those who have been following the case pointed out that it may be unreasonable for Microsoft to say it has unfairly been excluded from the search market if it had not invested in improving its product so that it can rival Google.

However, Parakhin still accused Apple of unfairly refusing to consider Bing as its default search engine: “My impression is that Apple doesn’t really consider switching….[T]hey use us as a bargaining chip against Google.”

Bing takes to the stand and highlights Google’s ‘less obvious’ advantages (Sept. 26)

CEO of Advertising and Web Services at Microsoft, Mikhail Parakhin, testified and highlighted some of Google’s less obvious advantages over rival search engines.

For example, he explained that fixing errors in business hours on Google or Bing requires similar effort. However, due to Google’s higher user traffic, businesses are more inclined to update their hours on Google rather than on Bing or other search engines.

Parakhin claimed this contributes to Google’s superior quality compared to other search engines, reports Big Tech on Trial.

DuckDuckGo calls out Google (Sept. 21)

DuckDuckGo founder and CEO Gabriel Weinberg told the court that changing a default search engine is “way harder than it needs to be.”

He added: “If you switch some of these defaults eventually you’re just going to be switched back to Google if you do nothing.”

His comments come after Google claimed that changing a default search engine is easy.

Search engine users do not have a choice, says DuckDuckGo (Sept. 21)

CEO of the privacy-focused search engine and internet browser company, Gabriel Weinberg, testified that his company had attempted to negotiate deals to become the default search engine on some products. However, he alleged he was unsuccessful as Google already had deals in place, reports Big Tech On Trial.

During Weinberg’s cross-examination by Google, Google’s lawyer pointed out that DuckDuckGo’s market share is lower in Europe compared to the United States, even in countries where a default search engine choice screen has been introduced.

Weinberg stated in his testimony that he believed the choice screens in Europe were designed in a manner that didn’t offer users a significant choice, but insisted that a more efficient choice screen could be implemented.

Google default deal blocked opportunities for Branch Metrics (Sept. 21)

Company founder, Alex Austin, who served as its CEO until only a few months ago accused Google of creating an unfair search landscape with its default status deals.

Branch Metric’s objective was to create a search engine specially for apps, that would serve app page from search queries using a “deep linking” technology.

Austin hoped phone manufacturers would roll out the new feature to products, creating a new source of ad revenue, while boosting reach for app developers.

Despite believing this would create a “win-win-win” situation, every company Austin pitched the idea to rejected Branch allegedly due to contracts in place with Google.

Microsoft claims the search market is ‘bogus’ (Oct. 2)

Microsoft’s Chief Executive Officer Satya Nadella, who was instrumental in the development of Bing, took to the stand and claimed that the idea that people have a choice when it comes to search engines is “bogus”, reports Bloomberg.

He told the judge: “You get up in the morning, you brush your teeth and you search on Google.”

Nadella added: “I see search or internet search as the largest software category out there. We are a very very low share player. But we continue to persist in it because we think of it as a software category we can contribute to.”

“It’s a hard game to make any breakthroughs, but no one can accuse us of not being persistent.”

Google owns the web, suggests Microsoft (Oct. 2)

Nadella implied that Google controls the Internet, reports CNBC.

He said: “Everybody talks about the open web, but there is really the Google web.”

Microsoft calls for search to be more competitive (Oct. 2)

Nadella claimed Microsoft is a “very, very low-share player” in the general search market despite investing $100 billion in Bing over the past 20 years.

He said that the only reason the tech giant decides to remain in the search field is because it wants to “make search more competitive” by running it like a “public utility.”

AI could make the unfair search industry even worse (Oct. 2)

Nadella told the court how he believes continued advancements in AI could make it even harder for startup search engines to compete against Google, reports the Verge.

The Microsoft CEO claimed there is a risk Google will start signing exclusive agreements with publishers to train its own models, which would ban competitors from crawling that data.

He said: “I worry that this vicious cycle I’m trapped in, is only going to get more vicious.”

Google search ads ‘can’t be replaced’ (Oct. 4)

Joshua Lowcock, Global Chief Media Officer at a media agency called Universal McCann, told the judge that search ads cannot be replaced by other digital ads, such as Facebook ads – contrary to Google’s claims, reports Big Tech on Trial.

He told the judge that search ads are “mandatory” in any advertising campaign and admitted he wouldn’t tell clients to redirect ad spend to different platforms if Google increased its prices by 5%.

However, Lowcock did admit that ads on Google, Bing, YouTube, and Amazon cater to different stages of the purchase process.

Despite some competition between Google and non-general search engines for ads, this doesn’t undermine the market definitions suggested by the DOJ and the States. In other words, Google can’t argue that digital advertising should be considered a broad market simply because some companies shifted ads from Google to Facebook due to Google’s price increases.

Google’s default search deals

Apple allegedly didn’t want a default search engine (Sept. 12)

The DOJ revealed that Apple intended to provide users with a choice screen to select between Google and Yahoo as their search engine.

However, Google rejected this proposal with the statement “No default placement, no revenue share,” as stated in an email.

Kenneth Dintzer, the lead attorney for the DOJ, characterized Google’s response as a monopolistic action.

Apple considered creating its own search engine if Google deal wasn’t agreed (Sept. 26)

Apple executive Eddy Cue claimed the company was contemplating developing its own search engine if a deal with Google did not materialize, according to Big Tech on Trial.

The statement supports the DOJ’s claim that Google’s payments to Apple caused the tech giant not to enter the search engine market.

If a competitor avoids entering the market altogether due to Google’s default search engine agreements, it would be a straightforward anticompetitive effect of Google’s default search engine deals.

Apple ‘acknowledged Bing is superior to Google on desktop’ (Sept. 28)

Microsoft’s Parakhin claimed Apple executive John Giannandrea agreed Bing is superior to Google on desktop.

Despite this, Google remains the default search engine on Mac computers.

Microsoft and the DOJ claim Google’s automatic default status with Apple deters rival companies from investing in making their products serious competitors.

Google pays $10 billion a year to maintain default status (Sept. 12)

Justice Department attorney Dintzer accused Google of recognizing the important of default status and said this was the reason why the company spent more than $10 billion a year to brands like Apple.

Dintzer added that ” this wheel has been turning for more than 12 years and it always turns to Google’s advantage.”

He claimed Google staff had previously described losing the company’s search default status on mobile as a “code red situation”.

Google’s counterargument said that despite commanding 90% of the search market share, it faces competition from companies like Amazong, Microsoft’s Bing and Yelp.

Google attorney John Schmidtlein, added: “There are lots of way users access the web other than default search engines, and people use them all the time.”

Google’s search engine default status on phones was a ‘priority’ (Sept. 13)

Chris Barton, who worked for Google from 2004 to 2011, said negotiating deals to make Google the default search engine on mobile devices was a top priority during his time at the company.

He claimed that in return for default status, phone service providers and manufacturers were guaranteed a portion of ad click revenue.

This strategy, central to the government’s antitrust case, aimed to establish Google as the primary search engine across various devices, reports News Bytes.

Google faced competition to become default search engine on mobile (Sept. 13)

Former Googler, Barton, emphasized that Google faced competition from other search engines in becoming the default choice for phone companies during his testimony,.

In a 2011 email exchange, Google executives observed that AT&T had selected Yahoo as its default search engine, while Verizon had opted for Microsoft’s Bing.

Barton testified that he encountered a challenge because mobile carriers were fixated on revenue share percentages.

He aimed to convince potential partners that Google’s high-quality searches would lead to more clicks and greater advertising revenue, even with a lower percentage share.

Microsoft claims it offered to pay Apple more than Google for default status (Sept. 29)

Microsoft’s corporate vice president for business development Jon Tinter took to the stand to talk about the lengths Microsoft went to in order to sign a deal with Apple.

The tech giant made an offer that would share more than 100% of its revenue. However, Apple allegedly chose to remain with Google – which was allegedly offering 60%, reports Big Tech On Trial.

He said: “We were just big enough to play but probably not big enough to win, if that makes sense.”

This suggests that Apple’s decision to make Google its default search engine was not solely financial.

Samsung ‘shut down default search engine conversations with Microsoft for Google’ (Sept. 29)

Tinter went on to reveal that Microsoft had also tried to pitch Samsung.

However, he claims these conversations were shut down by the tech giant in their early stages.

Tinter allegedly asked Samsung to at least allow Microsoft to make it an offer.

Samsung reportedly told Tinter that the deals were not worth discussing because of the company’s ongoing agreements with Google.

Verizon appears to contradict Google (Sept. 19)

Brian Higgins, Verizon’s Chief Customer Experience Officer, claimed he did not see the purpose in making a specialized search platform like Yelp the default option on Android phones, reports Big Tech on Trial.

His open-court testimony appeared to support the DOJ’s argument that Google competes primarily in the general search market, pitted against services like Bing and DuckDuckGo.

Google, however, disputed this claim, arguing that it also contends with specialized search platforms like Yelp, Expedia, and Amazon for specific user queries.

Higgins also testified that Verizon didn’t seek bids from other search providers during the recent renegotiation of the default search engine deal with Google.

This contradicts Google’s defense that it obtains exclusive contracts through fair competition, as previous years saw competition between Microsoft and Google for the default search engine position.

Pitching Bing to Apple (Oct. 2)

Microsoft CEO Nadella went on to claim that he has “focused every year of my tenure as CEO to see if Apple would be open” to replacing Google with Bing as its products’ default search engine, reports CNBC.

He acknowledged that such a move would carry risks, but claimed the hurdle could be overcome, pointing to Apple’s “turbulent” start with its maps app. He said that the app still went on to become popular despite its rocky beginning because it was the default map on Apple phones.

Microsoft was prepared to take a multibillion-dollar short-term loss in a deal that would see Apple replace Google with Bing as its products’ default search engine – but Apple said no.

‘Google is buying its way to squelch competitors’, claims Samsung email (Oct. 4)

An email exchange between former Samsung employee Patrick Change and his boss David Eunn in July 2020 discussed a new default agreement with Google.

“The current agreement is looking like Google will own all search on device….This will completely kill all potential for any branch search and other future services….[A]ll this will be killed if this Google agreement happens,” wrote Chang, reports Big Tech On Trial.

His boss responded: “Google is clearly buying its way to squelch competitors….Outside of a potential antitrust action, I don’t see Samsung refusing these terms.”

Potentially anticompetitive conduct

Google admits it quietly increases ad prices without telling advertisers (Sept. 18)

Google has admitted to quietly tweaking advertising auctions to meet revenue targets.

The search engine “frequently” changes the auctions it uses to sell search ads, increasing the cost of ads and reserve pricing by as much as 5% for the average advertiser.

For some queries, the tech giant may have even raised prices by as much as 10%, according to Google Ad executive, Jerry Dischler at the federal antitrust trial.

Google tends “not to tell advertisers about pricing changes”, he added.

If Google can raise ad prices without facing significant competition, it could strengthen the Justice Department’s case that Google holds an illegal monopoly. This is an argument the department can’t use against Google’s search engine itself, as it’s a free product for users. However, they can argue that increased competition could have addressed other issues, such as privacy standards, in the search industry.

Google’s Search Ads 360 integration issues make the problem worse, says Microsoft (Oct. 2)

The DOJ also hopes to prove that Google used its search ad tools to put its competitors at an unfair advantage.

While Microsoft has taken steps to ensure advertisers can move campaigns between Bing and Google’s search tools, integration issues with Google’s Search Ads 360 persists.

Nadella added: “We keep asking for them to add some features that we want and I think they ask us to go pound sand.”

Google ‘hid and destroyed evidence’ (Sept. 12)

Justice Department attorney Kenneth Dintzer accused Google of “hiding and destroying documents because they knew they were violating the antitrust laws”, reports Bloomberg.

“The sheer volume of destroyed documents is remarkable,” the DOJ claimed, reports Fast Company. “By intentionally destroying employee chats and making repeated misleading disclosures to the United States, Google violated federal rules on litigation.”

In his opening statement on day one, Dintzer presented evidence to show that Google was knowingly breaking laws.

He pointed to an October 2021 chat message from CEO Pichai, which read: “Need the link for my leaders circle tomorrow…can we change the setting of this group to history off… thanks.”

When history is off, conversations are auto-deleted after 24 hours.

Google declined to comment.

Googlers were told to be mindful of their language (Sept. 13)

Google staff were allegedly told back as far as 2023 to avoid using certain terms to avoid being perceived as “monopolists”.

A memo written by Google Chief Economist Hal Varian read: “We have to be sensitive about antitrust considerations…We should be careful about what we say in both public and private.”

Staff were told to avoid terms like “market share” and “bundle”.

Additional legal issues

DOJ objects Google’s request to remove public from courtroom (Sept. 18)

Google’s lawyer Schmidtlein asked for discussions of pricing to take place in a closed session, reports Reuters.

If this request was granted, the public and press would be forced to leave the courtroom.

However, David Dahlquist, senior trial counsel in the antitrust division at the DOJ, objected, arguing: “This satisfies public interest because it’s at the core of the DOJ case against Google.”

DOJ removes Google evidence from its website (Sept. 20)

Google lawyer John Schmidtlein complained to Judge Amit Mehta that the DOJ was sharing every piece of evidence with the public.

The judge told the court he was surprised to learn the DOJ had not informed him before publishing evidence on its website.

DOJ attorney Kenneth Dintzer quickly apologized and all documents were then shortly taken down.

Now that access to vital evidence has been taken away, it’s going to be a lot tougher for the public to keep up with this landmark case, which could shape the future of the Internet.

DOJ may start sharing evidence with the public again (Sept. 26)

Judge Mehta addressed the issue of the DOJ publicly posting evidence from the trial.

A joint status report from Google and the DOJ highlighted the search engine’s main disagreement; how long Google could review exhibits for confidentiality before DOJ posted them online.

The ruling: Google and affected third parties will have a three-hour window moving forward after the DOJ provides them with exhibit copies to review for confidentiality issues at the end of each trial day.

If all parties act promptly, the public can expect the DOJ to post admitted evidence nightly to its website at around 8 or 9pm ET.

If there is a disagreement between Google or a third party and the DOJ, the posting will be delayed until the disagreement is resolved in court the next day.

Google explains how its advertising auctions work (Oct. 3)

The Department of Justice (DOJ) investigated Google’s advertising auctions by questioning Dr. Adam Juda, Vice President of Product Management in Search Ads Quality Systems, reports Big Tech On Trial.

In these auctions, Google doesn’t always choose the highest bidder but employs a complex formula considering long-term value (LTV) offered by the ad.

Juda clarified that Google adopts this approach to avoid compromising the quality of ads. If Google only favored the highest bidder, it might lead to low-quality ads unrelated to search queries, harming the overall value of Google ads over time. Instead, Google ranks ads based on bid price, predicted click-through rate (PCTR), and a “Beta” factor estimating long-term negative effects. This is simplified in the formula: LTV = bid price x PCTR – Beta.

In this system, advertisers with lower-quality ads must bid higher to secure top positions. Ads with an LTV below zero are eliminated, allowing only bids with positive LTVs to compete.

Google then used uses Randomized Generalized Second-Price (RGSP) auctions to pick a winner. The final winner among top bidders is randomized, and the winning bidder pays a price equal to the next-highest bid plus one cent.

Dr. Juda explained that randomization helps bids with slightly lower LTVs still have a chance, and the second-price approach ensures advertisers don’t worry about significantly over-bidding, leading to a more stable and “advertiser-friendly” mechanism.

DOJ claims Google isn’t transparent regarding advertising auctions (Oct. 3)

The DOJ argued that advertisers aren’t informed about the details of how the LTV formula works or how their bids are ranked; it’s a “black box” system, as per Google’s internal documents.

While advertisers receive an ad quality score from 1-10, based on the same inputs as the secret LTV formula, the score itself isn’t used in the LTV formula. The DOJ seems to suggest that advertisers might have to place higher bids because they lack a clear understanding of how their bids are ranked.

The DOJ also suggested Google has the ability to influence ad prices through frequent “ad launches.” Although Juda disagreed, the DOJ claimed that Google could increase ad prices without much consideration for competition.

DOJ accuses Google of using unfair tactics to increase ad prices (Oct. 4)

Upon cross-examination from the DOJ, Google exec Adam Juda was asked if he supported a document sent to the EU by Google stating that it could “directly affect [ad] pricing through tunings of our auction mechanisms.”. He said he did not.

Juda then told the court that “tuning” can impact ad pricing and that it was “fair” to say Google had introduced ad sales changes in a way that increases the cost-per-click by a consumer that advertisers pay.

However, he later added when quizzed by Google that the search engine could not raise prices unilaterally.

Verdict. U.S. District Judge Amit Mehta isn’t expected to issue a ruling until early next year. If he decides Google broke the law, another trial will decide what steps should be taken to rein in the Mountain View, California-based company.

Why we care: If the US Government wins this case, it could mean Google is no longer automatically installed as the default search engine on everyday products, which could threaten its position as the world’s search leader. This means rival companies like Yahoo could realistically stand a chance of taking Google’s crown for the first time, which could bring significant changes to the search landscape as we know it.

What’s at stake. The U.S. and state allies are not asking for money; they want a court order to stop Google from its alleged unfair practices. This order could greatly affect Google’s business. For example:

The court could potentially split up the company as a solution.

On a broader scale, the Justice Department might argue that it aims to prevent Google from using its alleged search monopoly to secure exclusive deals in new markets, like AI.

This lawsuit is considered one of the most significant challenges to the tech industry’s dominance since the DOJ sued Microsoft in 1998 for its control of the personal computer market. In that case, the trial court ruled that Microsoft had unlawfully attempted to hinder the rival browser Netscape Navigator. Microsoft ultimately reached a settlement that didn’t break up the company.

If Google’s lead attorney Schmidtelein looks familiar, that may be because he represented Microsoft against the DOJ in the 1998 trial.

Deep dive. Read the US Justice Department’s official statement for more information on why it is suing Google.

The post Google search antitrust trial updates: Everything you need to know (so far) appeared first on Search Engine Land.